Announces 50% dividend increase from January dividend and share repurchase program with $3 billion targeted in fiscal 2024

Unveils a series of exciting new initiatives

Encourages shareholders to visit VoteDisney.com for more information

BURBANK, Calif., February 12, 2024 – The Walt Disney Company (NYSE:DIS) Board of Directors today sent a letter to shareholders highlighting its strong first-quarter FY24 results and significant steps Disney is taking as it successfully executes a strategic transformation of the Company.

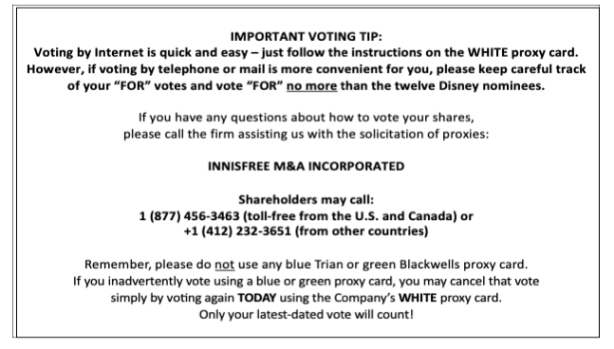

Disney’s Board of Directors urges shareholders to protect their investment and the future of the Company by voting the WHITE proxy card for only Disney’s 12 nominees and not the Trian Group or Blackwells nominees. The 2024 Annual Meeting of Shareholders will be held on April 3, 2024.

The Disney Board of Directors does not endorse the Trian Group nominees, Nelson Peltz and Jay Rasulo, or the Blackwells nominees, Craig Hatkoff, Jessica Schell and Leah Solivan, and believes that they do not possess the appropriate range of talent, skill, perspective and/or expertise to effectively support the Board’s ongoing efforts to drive profitable growth and shareholder value creation in the face of continuing, industry-wide challenges.

The Company’s proxy statement and other important information related to the Annual Meeting can be found at VoteDisney.com. The website also includes a video message to shareholders from Bob Iger https://votedisney.com/ceo-message. The full text of the letter follows.

***

VOTE THE WHITE PROXY CARD TODAY FOR ALL 12 OF DISNEY’S HIGHLY QUALIFIED DIRECTOR NOMINEES

February 12, 2024

Dear Fellow Shareholder,

Over the course of the last year, your Board and management team have executed an ambitious plan to return The Walt Disney Company to a period of sustained growth and shareholder value creation. On February 7, 2024, we announced very strong results for the first quarter of FY24 – results that demonstrate we have entered a new era at Disney. Today, the Company is building from a renewed position of strength.

Your Board and management team remain committed to driving meaningful growth and creating sustainable shareholder value long into the future. Our strategy is working, as evidenced by our strong financial results and a series of exciting announcements reinforcing the Company’s growth trajectory, including new direct-to-consumer plans from ESPN, a transformative collaboration with and investment in Fortnite’s Epic Games and significant upcoming content releases, such as a surprise animated sequel to Moana coming to theaters and Taylor Swift’s historic concert film, which will stream exclusively on Disney+.

Despite these efforts, two activist hedge funds, Trian Fund Management, L.P. and Blackwells Capital, are each seeking to replace members of your Board with their own separate nominees, none of whom your Board believes possess the appropriate range of talent, skill, perspective and/or expertise to effectively support Disney’s building priorities in the face of continuing industry-wide challenges.

That is why your vote using the WHITE proxy card FOR the election of ONLY your Board’s 12 nominees at the upcoming Annual Meeting is critically important. Visit VoteDisney.com today for more information on the Company’s strategy and how to vote your shares.

YOUR BOARD HAS OVERSEEN STRONG RECENT PERFORMANCE AND IS DEDICATED TO DRIVING GROWTH AND CREATING LONG-TERM SHAREHOLDER VALUE

“The stage is now set for significant growth and success,” said CEO Bob Iger, pointing to renewed vigor across all of our businesses.

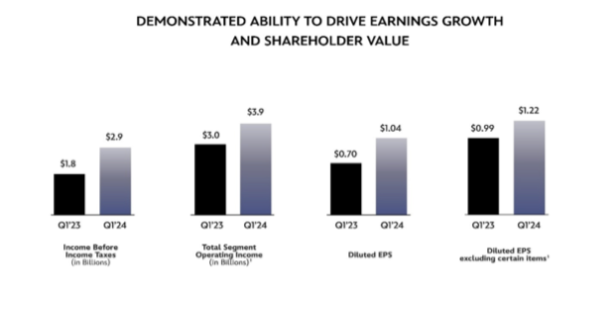

Disney’s first-quarter fiscal 2024 results demonstrate good progress on its strategic priorities:

- Significant YoY growth in income before income taxes and total segment operating income in the first quarter[1]

- Diluted earnings per share (EPS) for the first quarter increased 49% from the previous year to $1.04 per share

- Excluding certain items, diluted EPS for the first quarter increased 23% from the previous year to $1.22 per share[1]

- On track to generate roughly $8 billion in free cash flow in FY24[2]

- Expect full year fiscal 2024 EPS excluding certain items to increase by at least 20% versus 2023, to approximately $4.60[3]

Our continued turnaround in earnings and free cash flow gives us an opportunity not only to invest in our growth businesses, but also to increase shareholder returns while maintaining a strong balance sheet:

- Returned to paying a cash dividend in January 2024

- Declared a 50% increase to the January 2024 dividend, payable in July 2024

- Announced target of $3 billion common share repurchase in FY24, the first repurchases since FY18

DISNEY’S STRATEGIC TRANSFORMATION IS YIELDING STRONG RESULTS

We are building for the future, taking the necessary steps to position Disney as the preeminent creator of global content and a leader in technological innovation, and our first quarter FY24 results show we’re moving in the right direction:

Fortifying ESPN for the Future

- Announced a new joint venture with Fox and Warner Bros. Discovery, launching in the fall of 2024[4], to give ESPN customers and all sports fans more of the sports they want in a single place at a competitive price, available via a new app and as part of a Disney+ and Hulu bundle

- Released plans to make the full suite of ESPN’s channels available direct to consumer as a stand-alone and highly interactive digital destination before football season in 2025. When we launch our stand‐alone ESPN service, we will also make it available via Disney+ for bundle subscribers, similar to what we’ve done for Hulu

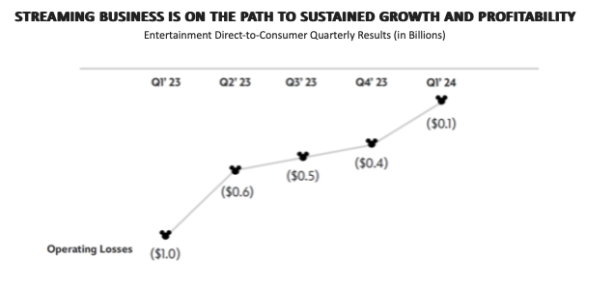

Building Streaming into a Profitable Growth Business

Disney has an ambitious streaming strategy that brings together our unparalleled branded and franchise content under Disney+, while we are also securing full control of Hulu and expanding our sports streaming offerings to reach even greater audiences. We have rationalized the business while investing in our core franchises. As a result of these efforts, entertainment direct-to-consumer (DTC) operating income improved 86% year-over-year.

We still expect to reach profitability at our combined streaming businesses in Q4 of fiscal 2024 and have never been more confident about our path to creating a strong and sustainable streaming business that we fully expect to be a key earnings growth driver for the Company. We are optimistic in prospects for ongoing subscriber growth in the longer term underpinned by:

- Strength of our slate

-

- 6/10 most streamed movies across all streaming platforms in the United States in 2023 were ours

- #1 most streamed children’s show across any streaming platform in Bluey (exclusive to the Disney Channel and Disney+ in the U.S.)

- Significant upcoming theatrical releases to be leveraged later on streaming, including Inside Out 2, Moana 2, Deadpool 3, Mufasa: The Lion King, and more

- Technological enhancements to improve engagement and lower churn

- Impact of Hulu on bundled subscribers

The beta launch of Hulu on Disney+ is exceeding every metric we planned for, and we are looking forward to the full launch next month as we offer an even more unified streaming experience to consumers.

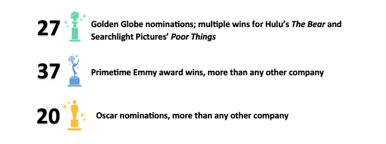

Reinvigorating our Creative Engines

Disney’s film studios and creative teams are the heart of our business – that’s why one of the key steps we took as we restructured and streamlined our business was to put more decision-making power back in the hands of our creative teams while rationalizing costs.

BEST IN CLASS STORYTELLING CONTINUES TO ACHIEVE CRITICAL SUCCESS

We are incredibly excited about our upcoming slate of new theatrical releases as we revitalize our powerful content engines, including an animated sequel to Moana coming this November along with Kingdom of the Planet of the Apes, Inside Out 2, Deadpool 3, Alien: Romulus, and Mufasa: The Lion King.

Turbocharging Growth in Parks and Experiences

One of the things that truly sets Disney apart is our unique ability to turn top quality IP into top quality experiences. Given our unrivaled and growing library of popular stories and characters, as well as our innovative technology, buildable land, unmatched creativity, and strong returns on invested capital, we are confident about the growth potential from our new investments in this business.

- Disney’s Experiences business generated all-time records in revenue, operating income, and operating margin in Q1

- Guests have enthusiastically responded to World of Frozen at Hong Kong Disneyland and our new Zootopia land at Shanghai Disney Resort

- Disney has many untapped stories waiting to be brought to life in Parks across the globe as investment continues

Games

It’s not just our parks where we’re creating new opportunities for consumers to engage with the characters and franchises they love.

We have entered into an agreement to acquire an equity stake in Epic Games alongside a multiyear collaboration on an all-new games and entertainment universe, bringing together Disney’s beloved brands and franchises with the hugely popular Fortnite in Disney’s biggest-ever entry into the world of games, offering significant opportunities for growth and expansion in the gaming space.

We know our consumers and our investors have high expectations for Disney and we are taking all steps necessary to build for the future and find ways to exceed those high expectations.

VOTE THE WHITE PROXY CARD FOR ONLY DISNEY’S 12 NOMINEES TO PROTECT ITS FUTURE

Disney has the right Board and management team in place to continue delivering on our strategic transformation, with the relevant skillsets, experiences, professional backgrounds and diversity of perspective necessary to position this Company for long-term growth, success and value creation.

Your Board urges you to vote the WHITE proxy card FOR ONLY Disney’s 12 nominees. We recommend you not vote using any blue proxy card from the Trian Group or green proxy card from Blackwells. Please disregard and discard those cards.

Thank you again for your investment in and commitment to The Walt Disney Company.

Sincerely,

The Walt Disney Company Board of Directors

Forward-Looking Statements

Certain statements in this communication may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding the Company’s expectations; beliefs; plans; strategies; business or financial prospects or outlook; future shareholder value; expected growth and value creation; profitability; investments; capital allocation, including dividends and share repurchases; earnings expectations; expected drivers and guidance, including future adjusted EPS, free cash flow and funding sources; expected benefits of new initiatives; cost reductions and efficiencies; content offerings; priorities or performance; and other statements that are not historical in nature. These statements are made on the basis of the Company’s views and assumptions regarding future events and business performance and plans as of the time the statements are made. The Company does not undertake any obligation to update these statements unless required by applicable laws or regulations, and you should not place undue reliance on forward-looking statements.

Actual results may differ materially from those expressed or implied. Such differences may result from actions taken by the Company, including restructuring or strategic initiatives (including capital investments, asset acquisitions or dispositions, new or expanded business lines or cessation of certain operations), our execution of our business plans (including the content we create and intellectual property we invest in, our pricing decisions, our cost structure and our management and other personnel decisions), our ability to quickly execute on cost rationalization while preserving revenue, the discovery of additional information or other business decisions, as well as from developments beyond the Company’s control, including: the occurrence of subsequent events; deterioration in domestic or global economic conditions or failure of conditions to improve as anticipated, including heightened inflation, capital market volatility, interest rate and currency rate fluctuations and economic slowdown or recession; deterioration in or pressures from competitive conditions, including competition to create or acquire content, competition for talent and competition for advertising revenue; consumer preferences and acceptance of our content and offerings, pricing model and price increases, and corresponding subscriber additions and churn, and the market for advertising and sales on our direct-to-consumer services and linear networks; health concerns and their impact on our businesses and productions; international, political or military developments; regulatory or legal developments; technological developments; labor markets and activities, including work stoppages; adverse weather conditions or natural disasters; and availability of content. Such developments may further affect entertainment, travel and leisure businesses generally and may, among other things, affect (or further affect, as applicable): our operations, business plans or profitability, including direct-to-consumer profitability; our expected benefits of the composition of the Board; demand for our products and services; the performance of the Company’s content; our ability to create or obtain desirable content at or under the value we assign the content; the advertising market for programming; income tax expense; and performance of some or all Company businesses either directly or through their impact on those who distribute our products.

Additional factors are set forth in the Company’s Annual Report on Form 10-K for the year ended September 30, 2023, including under the captions “Risk Factors”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business”, and subsequent filings with the Securities and Exchange Commission (the “SEC”), including, among others, quarterly reports on Form 10-Q.

Additional Information and Where to Find It

Disney has filed with the SEC a definitive proxy statement on Schedule 14A, containing a form of WHITE proxy card, with respect to its solicitation of proxies for Disney’s 2024 Annual Meeting of Shareholders. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) FILED BY DISNEY AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT ANY SOLICITATION. Investors and security holders may obtain copies of these documents and other documents filed with the SEC by Disney free of charge through the website maintained by the SEC at www.sec.gov. Copies of the documents filed by Disney are also available free of charge by accessing Disney’s website at www.disney.com/investors.

Participants

Disney, its directors and executive officers and other members of management and employees will be participants in the solicitation of proxies with respect to a solicitation by Disney. Information about Disney’s executive officers and directors is available in Disney’s definitive proxy statement for its 2024 Annual Meeting, which was filed with the SEC on February 1, 2024. To the extent holdings by our directors and executive officers of Disney securities reported in the proxy statement for the 2024 Annual Meeting have changed, such changes have been or will be reflected on Statements of Change in Ownership on Forms 3, 4 or 5 filed with the SEC. These documents are or will be available free of charge at the SEC’s website at www.sec.gov.

Non-GAAP Financial Measures

This presentation includes the presentation and discussion of certain financial information that differs from what is reported under U.S. GAAP, including total segment operating income, diluted EPS excluding certain items and free cash flow. These measures should be reviewed in conjunction with the most comparable GAAP financial measures and should not be considered substitutes for, or superior to, those GAAP financial measures.

“Total segment operating income” is a non-GAAP financial measure calculated as income before income taxes less certain non-operating factors. Disney’s management believes that information about total segment operating income allows investors to evaluate changes in the operating results of Disney’s portfolio of businesses separate from non-operational factors that affect net income, thus providing separate insight into both operations and other factors that affect reported results. A qualitative reconciliation of historical measures of total segment operating income to income before income taxes, which is the most directly comparable GAAP measure, is provided at the end of this letter.

“Diluted EPS excluding certain items” is a non-GAAP financial measure calculated as diluted EPS less certain items affecting comparability of results from period to period and amortization of TFCF and Hulu intangible assets, including purchase accounting step-up adjustments for released content. Disney’s management believes that information about diluted EPS excluding certain items allows investors to evaluate the performance of Disney’s operations exclusive of these items, which is how senior management evaluate segment performance. Qualitative reconciliation of historical measures of diluted EPS excluding certain items to diluted EPS, which is the most directly comparable GAAP measure, is provided at the end of this letter. Disney is not providing forward-looking measures for diluted EPS, or a quantitative reconciliation of the forward-looking diluted EPS excluding certain items to that most directly comparable GAAP measure. Disney is unable to predict or estimate with reasonable certainty the ultimate outcome of certain items required for the GAAP measure without unreasonable effort. Information about other adjusting items that is currently not available to Disney could have a potentially unpredictable and significant impact on its future GAAP financial results.

“Free cash flow” is a non-GAAP financial measure calculated as cash provided by continuing operations less investments in parks, resorts and other property. Disney’s management believes that information about free cash flow provides investors with an important perspective on the cash available to service debt obligations, make strategic acquisitions and investments and pay dividends or repurchase shares. Disney is not providing forward-looking measures for cash provided by continuing operations, which is the most directly comparable GAAP measure, or a quantitative reconciliation of the forward-looking free cash flow to that most directly comparable GAAP measure. Disney is unable to predict or estimate with reasonable certainty the ultimate outcome of certain items required for the GAAP measure without unreasonable effort. Information about other adjusting items that is currently not available to Disney could have a potentially unpredictable and significant impact on its future GAAP financial results.

Investor Contact:

Alexia Quadrani

The Walt Disney Company

Investor Relations

(818) 560-6601

alexia.quadrani@disney.com

Media Contacts:

David Jefferson

The Walt Disney Company

Corporate Communications

818-560-4832

david.j.jefferson@disney.com

Mike Long

The Walt Disney Company

Corporate Communications

(818) 560-4588

mike.p.long@disney.com

Steve Lipin

Gladstone Place

(212) 230-5930

slipin@gladstoneplace.com

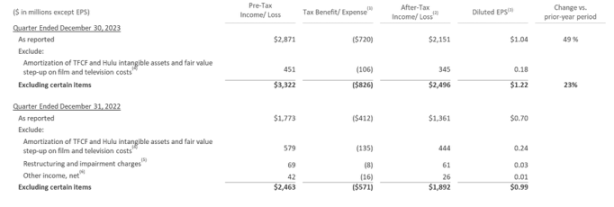

Reconciliation of Diluted EPS Excluding Certain Items for Q1

(In Millions except EPS)

The following table reconciles reported diluted EPS to diluted EPS excluding certain items for the first quarter:

- Tax benefit/expense is determined using the tax rate applicable to the individual item

- Before noncontrolling interest share

- Net of noncontrolling interest share, where applicable. Total may not equal the sum of the column due to rounding

- For the current quarter, intangible asset amortization was $380 million, step-up amortization was $68 million and amortization of intangible assets related to TFCF equity investees was $3 million. For the prior-year quarter, intangible asset amortization was $417 million, step-up amortization was $159 million and amortization of intangible assets related to TFCF equity investees was $3 million

- Charges related to exiting our businesses in Russia

- DraftKings loss ($70 million), partially offset by a gain on the sale of a business ($28 million)

Reconciliation of Total Segment Operating Income for Q1

(In Millions)

The following table reconciles income before income taxes to total segment operating income ($ in millions):

[1] Total segment operating income and diluted EPS excluding certain items are non-GAAP financial measures. The most comparable GAAP measures are income before income taxes and diluted EPS, respectively. See how we define and calculate these measures and reconciliations thereof to the most directly comparable GAAP measures at the end of the letter.

[2] Free cash flow is a non-GAAP financial measure. The most comparable GAAP measure is cash provided by operations. See how we define and calculate this measure and why Disney is not providing a forward-looking quantitative reconciliation to the most comparable GAAP measure at the end of this letter.

[3] Diluted EPS excluding certain items is a non-GAAP financial measure. The most comparable GAAP measure is diluted EPS. See how we define and calculate this measure and why Disney is not providing a forward-looking quantitative reconciliation to the most comparable GAAP measure at the end of this letter.

[4] The formation of the pay service is subject to the negotiation of definitive agreements among the parties.